-

During the 1990s and 2000s most countries established regulatory authorities and developed sophisticated methods of regulating their network companies and associated markets for electricity, gas, telecommunications and water. Within the EU, there are now explicit legal requirements for the independence of regulatory authorities, their functions and powers, and for the principles and methods they should use for regulating the natural monopoly networks.

European electricity regulators have started to modify regulatory methods in response to the challenges of integrating RE into the electricity network. The main area of regulatory innovations is in offshore wind connection, where three different European models currently exist side by side. These innovative models were analysed on Part 1 of the series of two papers. In this Part 2, the comparison of the three regulatory models forms the basis for assessing the regulatory regime for network companies in China, and for proposing improvements to the reform plans for transmission and distribution that are being implemented.

There are some major differences between Europe and China in terms of policy, experience and progress with offshore wind, and also in terms of future trends and perceived main problems. In particular, network connection issues of offshore wind, the focus of much analysis in Europe, are not recognised as problematic in China❶. Partly this is related to sizes and locations of wind farms in relation to the existing network and the centres of electricity demand. Some typical features are depicted in Table 1.

表 Tab.1 Typical features of offshore and onshore wind connections in China and Europe

Region Typical size of wind farms Technology/ Cabling Distances from main system connection point and from demand centres Grid development at nearest connection point of main grid Region located near wind farm has energy surplus or deficit China Onshore Large Overhead transmission(HVAC*, HVDC*) Long Weak Surplus China Offshore Medium Sub-sea cabling (MVAC*, HVAC*) ❷[2,3] Short Strong Deficit Europe Onshore Medium Overhead transmission (MVAC*, HVAC*) Short Strong Varies Europe Offshore Large Sub-sea cabling (MVAC*, HVAC*, HVDC*) Long Weak Surplus At the same time, the motivation for looking at offshore wind connection in China remains strong: Already the lack of experience of connecting OWPs to shore and the “lack of technical expertise in the design and construction of submarine cable and marine booster station” (Zhao and Ren, 2015:652)[1] are noted, and some authors expect that offshore wind power might face the same problems in terms of curtailment as onshore wind power in China, “with the added complexity of bringing power ashore” (Liu et al. 2013:795)[2]. While not yet as prominent as in Europe, the advantages of an interconnected offshore grid (as opposed to just radial connections) are beginning to be understood (Lu et al,2013)[3].

-

The cornerstone of the current RE support system in China is guaranteed FiTs, coupled with mandatory off-take arrangements and a cost sharing mechanism to share the burden of RE. This support mechanism was legally enshrined in the RE Law adopted in 2006 and amended in 2010. An overview of the mechanism and their evolution over time is provided by Zhao (2012)❸ as well as Ma (2011)[5].

In principle, RE legislation in China is very clear on the responsibilities for network companies with regard to dispatching and purchasing RE. Already in the original RE Law, network companies were obliged to buy all the power generated by RE plants. The obligations were further strengthened in the 2010 RE Law amendment, which also added requirements that network companies should adopt “advanced transmission and control technologies and enhance grid capacity to dispatch more power produced by renewable energy resources”(Ma, 2011:2637)[5]. For the past 10 years, there has been no shortage of Official Notices, Guidance Documents and Regulations aimed at enforcing the legal provisions (Table 2), but with limited effect.

表 Tab.2 Legal documents trying to enforce the REpriority dispatch obligations in China

Document Important content NDRC “The Regulation on the Administration of Power Generation from Renewable Energy”,2006, No 13. Oblige network companies to dispatch and purchase the entire amount of renewable electricity connected to their networks. SERC “The Measures on Supervision and Administration of Grid Enterprises in the Purchase of Renewable Electricity”,SERC 2007, No. 25. NEA “Interim Measures on the management of wind power development and construction” (2011). Wind power developments including network connections should follow an annual investment plan, which gets independently developed and must be implemented on schedule. NDRC “Opinion to Strengthen and Improve Generation Operation Management” (2014). Grid companies are obliged to fully incorporate renewable energy in annual generation plans and prioritise RE in dispatch, taking account reliability constraints. NDRC “Management Practices for protection of full renewable energy purchases” (2016 No. 625). NDRC and NEA will undertake annual allocations of operating hours for each type of RE; Grid companies undertake “energy saving dispatch”,conclude yearly contracts with renewable energy about guaranteed dispatch and pay compensation in case of curtailment; RE generators are encouraged to trade in the competitive market segments. There are major problems with the deployment of RE:

1)Connection: In 2011, one third of cumulative installed wind capacity was not connected to the grid (Kang 2012:1911)[10]. The rate of grid connected installed wind capacity was at its lowest in 2009 (68.48%), then increased steadily, but still in 2013 it was 84.87 % (Zeng et al. 2015:15)[8].

2)Curtailment❹:2012 saw the most serious wind curtailment in the history of China, 17.1%, causing “20.8 billion kWh of electric power losses” (Luo et al. 2016:1194)[11]. The situation improved in 2013 and 2014, with the average curtailment rate being around 9%, but 2015 saw an increase to 15.2% on average, with 43% in Jilin and Gansu, 31% in Xinjiang. In certain months within the fourth quarter of 2015, curtailment in parts of the Northeast reached 50%, and the first quarter of 2016 reported 26% curtailment. Curtailment even occurred in regions with well- developed network infrastructure and high electricity demand-for example 30% in Zhangjiakou, only 200 km from Beijing. For comparison, curtailment rates in Europe or the US are below 5% (Dupuy et al. 2015:12)[12].

These difficulties with network integration of RE, and wind in particular, are the subject of a large body of literature. Notably, in China network connection and network integration are often used interchangeably, which differs from the European literature on the subject. In the European understanding, RE network integration has two quite distinct parts: connection and balancing. The connection of a generator to an existing network and the transmission of the generated power, is a network company issue, and is influenced by the methods of economic regulation applied to the network companies. Conversely, the balancing aspect of RE network integration, while also “managed” by the network companies, is primarily an issue of adequate generation market design, and is influenced by the incentives given to the generation market to supply flexible generation sources able to work together with the variable RE generation. The root cause for missing the distinction between connection issues and balancing issues in China is the insufficient unbundling of network companies from generation, and hence this goes to the core of electricity sector reform.

In response to many issues facing China′s power sector, not least the problems with integrating RE, the government in 2015 set out a new reform agenda. The leading policy document “Several Opinions of the CPC Central Committee and State Council on Further Deepening the Reform of the Electricity Power System” of 5 March 2015, also known as Document No. 9 (CPC 2015) sets out 6 reform areas:

1)Changes to Transmission and Distribution (T&D) pricing and grid operations model.

2)Reforms to price setting and the formation of a market trading mechanism.

3)Generation and retail competition, and a diversity of retail entities.

4)New ancillary services market.

5)Demand-side management and new electric service companies.

6)Gradual transition from fossil fuels to renewables, and the creation of distributed energy markets.

Related to the network companies, the reform envisages the separation of the grid companies′ transport functions from the trading (purchasing and selling of energy) functions. Crucially, explicit price regulation for the network business will be introduced.

-

Part 1 of the paper defined the components for the regulatory regime for offshore wind: the existence of a regulator, the degree of network unbundling, the regulatory method used, and charging and responsibility allocation. We will consider these in turn with regard to the current and envisaged regulator regime in China.

-

The 2002 reform of the Chinese electricity sector envisaged measures familiar from worldwide electricity sector reforms, including removal from direct government control and creation of an independent regulator. However, the State Energy Regulatory Commission (SERC) never became a “truly independent regulator with formal and transparent rules for allocating costs in the electricity sector” (Kahrl et al. 2013:368)[13], particularly because it lacked the authority over price setting, and also because of weaknesses in its legal authority, organisation and human resource capabilities.

The situation did not change fundamentally when, in 2013, SERC was merged into the National Energy Administration (NEA). The new major duties of NEA included the drafting and implementing of plans and policies for energy development, production, distribution and reform, and regulating the power market (standardising operation and organising enforcement and investigations), but excluded price setting (Zheng 2015:86)[14].

Prices remain administratively set by NDRC, China′s macroeconomic policy authority, with responsibility for overall reform and macroeconomic balance, and are negotiated between generators, grid companies and the NDRC through an informal, non-transparent process(Ma 2011:2644[5], Zeng et al. 2016:97[15]).

-

The 2002 electricity reform succeeded in formally separating generation from other activities. However, the unbundling remained incomplete. The network companies stayed engaged in purchasing power from the generators and selling it to final consumers. The prices for each generator, so called “on-grid prices”❺,and each retail category are administratively set by NDRC. In addition, the generators are not dispatched in order of increasing variable cost of operation, a guiding principle adhered to in most of the world. Instead, China employs so called ‘equal shares dispatch′. This means that generators in any dispatch region are guaranteed a particular share of output required for this region, disregarding the cost characteristics of the individual plants❻. These shares are also set by NDRC.

While there are historic explanations for the emergence of this system, it “distorts investment decisions, hampers integration of renewable energy and increases costs and emissions” (Dupuy et al. 2015:8)[12]. Priority dispatch of RE plants does not fit with pre-determined shares for conventional generators. It also leads to an increase in wholesale power purchase costs for the transmission company in its role as a power purchase/sale entity. While some transmission companies may be able to pass the extra costs on to final customers❼,it is clear that without complete unbundling of network activities from potentially competitive activities the grid companies in China remain financially interested in the wholesale and retail elements of the value chain, and this is likely to distort any regulatory method employed.

-

Up to 2014, China did not have explicit regulation of the network activities. Instead, grid companies kept the difference between the cost of on-grid tariffs and revenue from retail tariffs and the “income of these companies is not calculated based on the assets and actual operation and maintenance costs. This creates a number of problems:

1)If the income of network companies is set as a residual between retail prices and wholesale prices, it is impossible to ensure that the costs incurred by the network company in its core business of transporting electricity and keeping a reliable system can be adequately compensated, or that the network companies are incentivised to operate more efficiently, or to invest efficiently.

2)For the integration of RE, this type of regulation is particularly damaging. The integration of renewables increases the required CAPEX of network companies due to the need to construct connections, network upgrading and strengthening. It also increases OPEX, because network operation with variable renewables is more complicated in terms of voltage and frequency control, and there might also be additional network losses (Zhao et al. 2012:4512)[6]. As the network company′s own costs are nowhere explicitly considered, there is no way to ensure that the network companies are compensated for these extra costs. Zheng (2015:101)[14] says that the costs of connecting RE producers to the grid are “not covered”,despite the cost sharing scheme set up in 2006 and intended for transmission companies to recover expenses for grid connection through a surcharge. Zhang and Li (2012:1114)[17] state that this surcharge (0.01 to 0.03 yuan/kWh depending on the distance of the wind farms from the main grid infrastructure) is not enough to encourage grid enterprises to accept wind power. Moreover, “the gap between the need and actual fund is more than 20 billion Yuan” and the “remaining cost of grid infrastructure beyond the subsidies of the renewable energy surcharge is underwritten by grid enterprises” (Lin and Li 2015:1380-1381)[16].

In 2014 a reform of the regulatory method for China′s transmission companies started with a pilot scheme in Shenzhen. From 2015, after the publication of Document No. 9, this method is being extended to several other provinces.❽

The principles of the new regulatory method are in line with usual regulatory principles: legality, relevance (focussing on the costs of the transmission and distribution business only), rationality (meaning only reasonable costs are being considered). By its nature, the regulatory method is a hybrid method, combining features of Rate of Return (RoR) as well as incentive regulation. The regulatory formula is a standard RoR formula: Allowed Revenue = Allowed Costs+RAB+WACC+Taxes, where the WACC is based on actual interest rates for borrowed funds, and on interest rates on Treasury bonds plus 1%~3% for the equity. The formula is applied based on actual data from the previous period and cost projections for OPEX and CAPEX, which are checked by the regulator. However, the allowed revenue is set for a regulatory period of 3 years, and it is stated that up to 50% of extra profits from cost efficiency improvements during the regulatory period can be retained by the companies.

There is no full realisation that one of the important features of incentive regulation is to avoid cost scrutiny within the regulatory period, but instead “continuous monitoring of the grid company′s assets, costs, revenues, services and other related information”. In addition, it is not clear, what method will be employed for cost reporting and checking at each regulatory review. Both of these factors might reduce the incentive regulation properties of the method.

There is a realisation that the implementation of the new regulatory method will be challenging: the need for research, in-depth analysis of problems, preparation and co-operation in this task. It is recognised that one important challenge is to establish the RAB for each network company, including those not involved in the first roll-out regions❾. It is also mentioned that network companies will need to “establish and improve … cost accounting systems according to the voltage level”.

Investments are included into the cost projections for the regulatory period based on “power grid planning and grid development investment plans”. It is not specified, which documents these are. Bearing in mind that the 12th FYP for the power grid was never unveiled and that planning co-ordination is one of the major problems facing the sector, vague references to unspecified planning documents are problematic. There is an additional provision regarding investments: If in a year within the regulatory period the company increases its fixed assets in excess of 20%, the allowed revenue will be adjusted within the regulatory period; below 20% the RAB will be adjusted only at the end of the regulatory period. This might lead to increased investment incentives for large grid projects.

Overall, the new regulatory method is still relatively “raw”,containing major uncertainties and implementation problems. But it is a hybrid between RoR and incentive regulation-“with RoR as the principle and price caps as the supplement” (Qiu and Li 2015:20), which is a good starting point.

-

Currently network users in China do not face direct tariffs for connection to the grid or the use of transport services. This refers to all users, including onshore and offshore wind plants. Consequently, the charging approach currently used in China can also only be understood indirectly.

According to Article 22 of China′s Electricity Law, network companies are obliged to accept requests of generators to connect to the network, and they are responsible for investing in the construction of transmission lines and the connection between wind farms and the nearest network. Developers are not allowed to begin construction before they have obtained grid connection approval. This would correspond to the super-shallow approach. However, network companies are not always fulfilling these obligations, so that “most wind farms in the Inner Mongolia Autonomous Region and Heilongjiang Province were forced to construct the transmission lines themselves” (Yang et al. 2012: 148)[20].

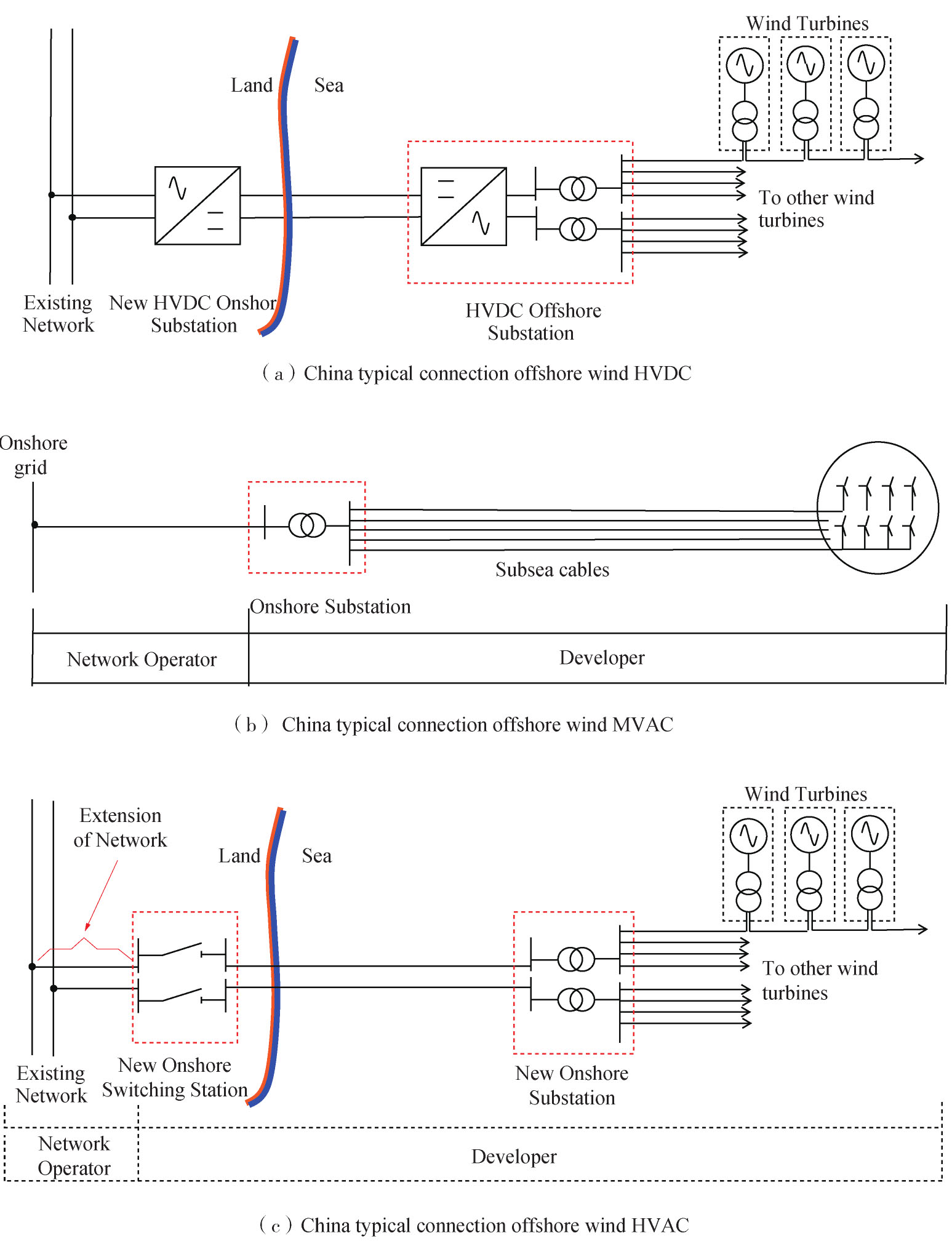

In practice, there is a variety of approaches for splitting the connection responsibility and hence costs between network companies and developers with regard to connection of wind power. Figure 1 depicts three “typical connection schemes” for offshore and onshore connections in China as provided by local experts working in the industry in China.

As can be seen, the onshore wind farm HVDC case is the closest to a super-shallow connection approach coupled with the TSO model. For the other two cases-offshore MVAC and onshore HVAC connections-the approach is similar to shallow charging using the generator model.

With the new regulatory method, network companies will charge a fee (tariff) for transported energy differentiated by voltage classes. However, it is not clear which network users will be subject to the new transmission and distribution tariffs and whether the tariff structure will include separate charges for connection.

-

Figure 2 below shows the current and future regulatory regimes for wind connection in China.

The current regime is highly problematic (Table 2). The lack of an independent regulator and of explicit regulation of the network companies, together with the incomplete unbundling are the most damaging aspects of China′s current regulatory regime.

表 Tab.2 Assessment of individual components of current regulatory regime for wind connection in China

Current regulatory regime Government Ministry Incomplete unbundling Super-shallow in law, shallow in practice No explicit regulation of TSO TSO model in theory/ generator model in practice Price Signal Red Red Yellow Red Yellow Cost Efficiency incentives Red Red Yellow Red Yellow Planning Yellow Yellow Yellow Red Yellow Timely Connection Investments Red Red Red Red Yellow It seems that the assessment in Table 2 depicts the current situation well: there are enormous problems with connection and transmission of wind power in China, but they do not totally deter connections.Table 3 depicts the assessment of the regulatory regime that would be expected on the basis of the recent reform measures.

表 Tab.3 Assessment of individual components of future regulatory regime for wind connection in China

Future regulatory regime Government Ministry Full unbundling Charging Hybrid regulator method Responsibility Super-shallow Shallow TSO Generator Price signal Red Yellow Red Green Yellow Yellow Green Cost efficiency incentives Red Yellow Yellow Yellow Yellow Yellow Green Planning Yellow Yellow Green Yellow Yellow Green Red Timeliness of connection Red Yellow Yellow Yellow Yellow Yellow Green On “charging” and “responsibility” two options are shown, because the intended regime is not yet clear. In order to fully specify the regime, most likely, the super-shallow approach would be combined with the TSO model, or the shallow charging approach with the generator model. If the mechanism remains undefined, the uncertainties will turn the “Yellow” into “Red”.

The main points of the assessment are:

1)The lack of an independent regulator is considered a problem for most assessment criteria, but the full unbundling and the new regulatory method for China′s network companies open up real possibilities for improvement.

2)One major trade-off between the TSO model and the generator model, as was discussed in Part 1, is between cost efficiency of the individual connection and wider planning. The TSO model scores better on planning because the TSO is able to co-ordinate several connections of OWPs, even to the extent of creating an offshore grid. The generator model scores better on cost efficiency because it employs competitive incentives to drive the costs of the individual connections down.

3)In China, the generator model combined with shallow charging would not incur additional costs compared to the super-shallow approach, because in China the investors in offshore wind are predominantly large state-owned power companies, which are likely to be able to access preferential loans and interest rates at par with the TSOs.

-

Section 2.5 applied the methodological framework for assessing regulatory regimes, which was developed for the European case studies in Part 1, to China′s current and future regulatory regimes for connecting wind power. The result confirms that there are major problems with connecting wind generation in China, but that the introduction of the transmission and distribution pricing reform-one of the areas of the 2015 power sector reform-has the potential to improve the current situation.

However, to realise this potential, further work on designing the regulatory regime should be undertaken; for determining the directions of such work, the experiences from the European case studies might be helpful, as long as underlying assumptions and priorities are considered. Among those assumptions, the main one relates to the nature of economic regulation, which is different in China compared to Europe.China′s network companies are SOE, which are subject to a governance system which is based on ‘command and control′,rather than incentives. For the applications of lessons from Europe, it needs to be borne in mind that, for the foreseeable future, incentives from economic regulation will be influenced (sharpened or weakened) by the existence of a parallel governance system.

In terms of priorities, the European approach is based entirely on the advantages of unbundling networks from generation, and on the long-term application of incentive regulation to the network companies. China′s network companies have not been subjected to incentive regulation, their operations have major efficiency deficits and hence the need to “reduce costs and improve efficiency” (Wang, 2015)[23] is a substantial one. One major priority for China is to find a mechanism for transmission projects related to wind plants that allows companies to make a return on such projects (Zeng et al. 2015:21)[8], while also inducing efficiency. Such mechanism could use any of the three models described in Part 1 of this series of papers, i.e. including the generator model, as China is unconstrained by Europe′s strict unbundling requirements or international co-ordination considerations. In addition, in China, arguably the most important priority is to improve transmission planning and co-ordinate it with generation planning and regional interconnection (Sun, 2015:598)[24]. Unlike Europe, China has no experience with a regulator led co-ordinated planning process in the electricity sector, which combines optimal system design with financial incentives and project approval. Instead it has a “chaos of development plans” (Zhao, 2016:471) [25]. Consequently, for applying lessons, it needs to be borne in mind that China′s priorities relate to creating conditions for planning and timely, as well as efficient, investments.

The following suggestions for improvement of China′s proposed transmission and distribution price reform can be offered:

1)China should review the allocation of regulatory functions in the electricity sector. There needs to be a formal, transparent ratemaking process. The case studies show European regulators demonstrating remarkable leadership and competence in addressing the increasing complexity of the regulatory task (considering the economic, environmental and social policy objectives). The crucial condition for such success is the independence and empowerment of these regulators which ensures that they can translate the competing aims and interests into concrete regulatory rules and methods-thereby creating a better (lower risk) investment environment for the energy companies. This would be in the spirit of Deputy Director of the National Energy Board of new and RE, Shi Lishan′s call for “institutional innovation” (Tencent, 2016)[26].

2)Currently the discipline of economic regulation is not well understood in China. It is recommended to study thoroughly the properties of different methods of economic regulation, both the theory, and the experiences gained by their practical implementation in different countries around the world. Based on such research, policymakers could then set out to design an optimal regulatory framework for China, considering specified regulatory objectives and priorities, as well as Chinese specifics-for example any interactions with other governance systems also directed at the network companies.

3)When designing the regulatory regime for China′s network companies′ connection of wind power-China should carefully analyse the different models. The European case studies have shown that there is no ideal model. Therefore, China has to determine the priorities, and then chose the model which best fulfils these priorities. If the priority is to shelter the wind developers from additional costs, to have a planned and co-ordinated development of plants across the country or at sea, and to have optimisation of connections, possibly an offshore UHV grid and offshore section of the global energy Internet, then the TSO model should be chosen. If the priority is to induce competition and increased cost efficiency in the wind connection business, and to apply strong cost efficiency incentives to the overall TSO business, then the generator model would be more suitable. The third-party model would offer an intermediate solution in addressing the various priorities.

4)Given that one major priority for the development of wind power in China is improvement of co-ordination of network and generation investments, there is a certain preference for using the TSO model. However, as was shown in the German case study, this model requires substantial modifications to the regulatory regime-particularly the creation of an independent regulator to guarantee the implementation of the fair and transparent regulatory system. In addition, the regime should include the creation of a legally binding network development plan, which forms the basis for generation investment as well as allowed investment costs for the network companies. This should be complemented by liability provisions for TSO′s non-fulfilment of connection deadlines. The current emphasis on the RoR element, as is already anticipated in the respective NDRC documents, should also be retained but the 20% threshold, which currently triggers an increase of the RAB within the regulatory period, could be replaced by a more specific incentive.❿

5)If the full implementation of the TSO model takes some time, or might prove impossible, the generator model would provide the default option-just as in the current system. As China′s wind power development is undertaken mainly by SOEs, it might be possible to use the instrument of a legally binding network development plan to co-ordinate generation and transmission investments. For the network companies′ regulation, the network development plan would provide the basis for the investment projections undertaken at the beginning of each regulatory period, as is anticipated in the NDRC methodologies. This could be complemented by quality targets set by the regulator to enforce timely building of connection and network re-enforcement assets.

6)The third-party model might be interesting for China because it combines some of the advantages of the TSO model and the generator model. It could be used as an extension of the generator model, or as trial method, to test out an innovative regulatory regime. For this model to be successful, a clear and transparent tender process needs to be designed, possibly using Ofgem′s experience.

However, Liu et al. (2013:796)[2] and Wu Jie (2014)[4] report that China′s transmission experts consider HVdc transmission technology preferable for larger scale OWPs. Indeed, Zhao and Ren (2015:649)[1] say: “there is no dilemma of grid connection and absorption for offshore wind power” due to its location near the consumption centres, which reduces the transmission costs, and “this is also one of greatest strengths”. See in particular history of wind power support in 6 stages starting in 1986 (Zhao 2012:227)[6]. For onshore, China has now 4 FiTs for each of 4 “wind regions”,a wind power benchmark price based on the benchmark price of newly constructed de-sulfurized coal and a subsidy component from central government. For offshore wind there are two benchmark prices. Curtailment is a “reduction in a generator′s energy output from what it could otherwise produce given available resources” (Dupuy et al. 2015:9) [12]. Their emergence and evolution has been well described by Ma (2011)[5]. On the history and implications of this, as well as the (limited and largely unsuccessful) experiments with Energy Efficient Dispatch (EED) in five provinces, see Kahrl et al.(2013)[13]. Lin and Li (2014:1380)[16] state that in case of energy efficient dispatch, there is no purchasing cost difference for grid enterprises. The results of the Shenzhen pilot have been reported as positive. Electricity prices in the province dropped, and the T&D prices are expected to decrease year by year from 2015 to 2017 (Yuan 0.1435, 0.1433, 0.1428 per kWh respectively. (CNESA 2015:2)[18]. These are Shenzhen, western Inner Mongolia, Anhui, Hubei, Ningxia and Yunnan (NDRC 2015: Art.1)[19]. Keyaerts and Meeus (2015)[27]. say that granting exceptional incentives can be done case-by-case to avoid overpaying for important, but low risk projects, and to avoid underpaying for important high-risk projects. It is typically a combination of reducing risk and increasing the return on investment, while also making the project promoters accountable for delays.

海上风电并网的经济调控——将欧洲经验应用于中国(下)

DOI: 10.16516/j.gedi.issn2095-8676.2018.03.002

CSTR: 32391.14.j.gedi.issn2095-8676.2018.03.002

Economic Regulation of Network Connection of Offshore Wind: Applying European Experience to China: Part Ⅱ

-

摘要:

[目的] 文章为两篇论文中的第二部分,着眼于将欧洲国家的经济调控管理经验应用于中国电力系统当前面临的紧迫挑战之一——海上风电的有效并网。 [方法] 文章通过分析比较调控机制,总结出海上风电监管机制的五个要素:监管实体、有效非绑定程度、补贴管理方法、并网价格制定方法以及责任主体。结合中国国家发改委2015年颁布的电改“9号文”分析了中国并网调控机制及相关机制的变化,这些变化包括为中国并网企业引入单独的经济调控机制,可形象称之为“管住中间、放开两头”。 [结果] 为了确保实现调控目标,如:配置效率、成本效率以及服务质量(包括陆上风电和海上风电的及时连接和输送等),新的监管方法仍需改进。两篇论文中的第一部分基于对三个欧洲案例的研究结果表明:TSO模型、发电机模型和第三方模型,都可以应用于中国。但是考虑到欧洲和中国的差异,建议中国采用和其首要目标最匹配的调控模式。 [结论] 如果中国的首要目标是改善发电和并网的协调发展,激励输电投资,则TSO模式是最好的选择。需要注意的是,采用具有法律约束力的并网计划、并网公司对于未能及时并网确立明晰的责任以及减少弃风弃光的发生,通过独立的监管机构来实施这一模式至关重要。 Abstract:[Introduction] This paper is Part 2 of two papers, looking at applying European countries′ experience with economic regulation to one of the urgent challenges of China′s electricity systems: namely the effective connection of offshore wind. [Method] Using a methodology of comparative analysis of regulatory regimes, five components of regulatory regimes for offshore wind are defined and assessed for China: regulatory entity, degree of effective unbundling, tariff regulatory method and connection charging method and responsible entity. The paper analyses the changes to China′s network regulatory regime under way through Document No. 9 and related regulatory changes, including the introduction of a separate mechanism of economic regulation for China′s network companies, vividly described as "take control of the middle, release the two sides" . [Result] The paper finds that the new regulatory methods still need refinement in order to ensure that they fulfil regulatory objectives such as allocative and cost efficiency, as well as quality of service-including timely connection and full transmission of onshore and offshore wind power. Based on the experience of three European case studies (Part 1 of the two papers), representing the TSO model, the generator model and the third-party model in Part 1, the paper concludes that in principle, all three models could be applied in China. Bearing in mind some similarities and differences in assumptions and priorities between Europe and China, the paper recommends that China adopts the regulatory model best aligned with its priorities. [Conclusion] If the most urgent priorities are to improve the co-ordinated development of generation and network capacities and to provide good incentives for transmission investments, the TSO model would be most suitable; however, it would be vital to implement this model through an independent regulator, with legally binding network planning and clear liabilities for the network companies′ failure to connect in time, and also incentives to reduce curtailments. -

Key words:

- offshore wind /

- network connection /

- institutional and regulatory

-

表 Tab.1 Typical features of offshore and onshore wind connections in China and Europe

Region Typical size of wind farms Technology/ Cabling Distances from main system connection point and from demand centres Grid development at nearest connection point of main grid Region located near wind farm has energy surplus or deficit China Onshore Large Overhead transmission(HVAC*, HVDC*) Long Weak Surplus China Offshore Medium Sub-sea cabling (MVAC*, HVAC*) ❷[2,3] Short Strong Deficit Europe Onshore Medium Overhead transmission (MVAC*, HVAC*) Short Strong Varies Europe Offshore Large Sub-sea cabling (MVAC*, HVAC*, HVDC*) Long Weak Surplus * Medium Voltage alternating current (MVAC), High Voltage alternating current (HVAC), High Voltage direct current (HVDC).

表 Tab.2 Legal documents trying to enforce the REpriority dispatch obligations in China

Document Important content NDRC “The Regulation on the Administration of Power Generation from Renewable Energy”,2006, No 13. Oblige network companies to dispatch and purchase the entire amount of renewable electricity connected to their networks. SERC “The Measures on Supervision and Administration of Grid Enterprises in the Purchase of Renewable Electricity”,SERC 2007, No. 25. NEA “Interim Measures on the management of wind power development and construction” (2011). Wind power developments including network connections should follow an annual investment plan, which gets independently developed and must be implemented on schedule. NDRC “Opinion to Strengthen and Improve Generation Operation Management” (2014). Grid companies are obliged to fully incorporate renewable energy in annual generation plans and prioritise RE in dispatch, taking account reliability constraints. NDRC “Management Practices for protection of full renewable energy purchases” (2016 No. 625). NDRC and NEA will undertake annual allocations of operating hours for each type of RE; Grid companies undertake “energy saving dispatch”,conclude yearly contracts with renewable energy about guaranteed dispatch and pay compensation in case of curtailment; RE generators are encouraged to trade in the competitive market segments. Source: Compilation from Ma (2011:2637)[5], Zeng et al. (2015:17)[8] and NDRC (2016)[9].

表 Tab.2 Assessment of individual components of current regulatory regime for wind connection in China

Current regulatory regime Government Ministry Incomplete unbundling Super-shallow in law, shallow in practice No explicit regulation of TSO TSO model in theory/ generator model in practice Price Signal Red Red Yellow Red Yellow Cost Efficiency incentives Red Red Yellow Red Yellow Planning Yellow Yellow Yellow Red Yellow Timely Connection Investments Red Red Red Red Yellow 表 Tab.3 Assessment of individual components of future regulatory regime for wind connection in China

Future regulatory regime Government Ministry Full unbundling Charging Hybrid regulator method Responsibility Super-shallow Shallow TSO Generator Price signal Red Yellow Red Green Yellow Yellow Green Cost efficiency incentives Red Yellow Yellow Yellow Yellow Yellow Green Planning Yellow Yellow Green Yellow Yellow Green Red Timeliness of connection Red Yellow Yellow Yellow Yellow Yellow Green Source: Author′s own analysis.

-

[1] ZHAO X G, REN L Z. Focus on the development of offshore wind power in China: has the golden period come? [J]. Renewable Energy, 2015(81): 644-657. [2] LIU T, TAVNER P, FENG Y, et al. Review of recent offshore wind power developments in China [J]. Wind Energy, 2013, 16(5): 786-803. [3] LU X, MCELROY M, NIELSEN C, et al. Optimal integration of offshore wind power for a steadier, environmentally friendlier, supply of electricity in China [J]. Energy Policy, 2013, 62(7): 131-138. [4] WU J, WANG Z X, WANG G Q. The key technologies and development of offshore wind farm in China [J]. Renewable and Sustainable Energy Reviews, 2014(34): 453-462. [5] MA J. On-grid electricity tariffs in China: development, reform and prospects [J]. Energy Policy, 2011, 39(5): 2633-2645. [6] ZHAO X L, WANG F, WANG M. Large-scale utilization of wind power in China: obstacles of conflict between market and planning [J]. Energy Policy, 2012, 48(3): 222-232. [7] ZHAO X L, ZHANG S F, YANG R, et al. Constraints on the effective utilization of wind power in China:an illustration from the northeast China grid [J]. Renewable and Sustainable Energy Reviews, 2012, 16(7): 4508-4514. [8] ZENG M, DUAN J H, WANG L, et al. Orderly grid connection of renewable energy generation in China: management mode, existing problems and solutions [J]. Renewable and Sustainable Energy Reviews, 2015(41): 14-28. [9] China National Development and Reform Commission(NDRC). Notice on the issuance of energy technology revolution innovation action plan (2016—2030): NDRC Energy 〔2016〕No. 513 [EB]. (2016-04-07). [10] KANG J, YUAN J, HU Z, et al. Review on wind power development and relevant policies in China during the 11th Five-Year-Plan period [J]. Renewable and Sustainable Energy Reviews, 2012, 16(4): 1907-1915. [11] LUO G L, LI Y L, TANG W J, et al. Wind curtailment of China′s wind power operation: evolution, causes and solutions [J]. Renewable and Sustainable Energy Reviews, 2016(53): 1190-1201. [12] DUPUY M, WESTEON F, HOVE A. Power sector deepening reform to reduce emissions, improve air quality and promote economic growth [R]. Chicago: Paulson Institute, 2015. [13] KAHRL F, WILLIAMS J, HU J F. The political economy of electricity dispatch reform in China [J]. Energy Policy 2013, 53(1): 361-369. [14] ZHENG X M. Regulatory incentives for a low-carbon electricity sector [D]. Queensland: The University of Queensland, 2015. [15] ZENG M, YANG Y Q, WANG L H, et al. The power industry reform in China 2015: policies, evaluations and solutions [J]. Renewable and Sustainable Reviews, 2016(57): 94-110. [16] LIN B Q, LI J L. Analyzing cost of grid-connection of renewable energy development in China [J]. Renewable and Sustainable Energy Review, 2015(50): 1373-1382. [17] ZHANG S F, LI X M. Large scale wind power integration in China: analysis from a policy perspective [J]. Renewable and Sustainable Energy Reviews, 2012, 16(2): 1110-1115. [18] China Energy Storage Alliance(CNESA). China′s new electric system reforms [EB/OL]. (2016-06-25). http://en.cnesa.org/featured-stories/2015/8/4/chinas-new-electric-system-reforms. [19] China National Development and Reform Commission(NDRC): Notice on accelerating T & D pricing reform: NDRC Energy 〔2015〕No. 742 [EB]. (2015-04-13). [20] YANG M, PATINO-ECHEVERRI D, YANG F X. Wind power generation in China: understanding the mismatch between capacity and generation [J]. Renewable Energy, 2012, 41(2): 145-151. [21] WAN J. Technical Manager DNV GL Shanghai: typical wind connection schemes [EB]. E-mail to Lewington.[2016-07-04]. [22] WYATT S, GOVINDJI A, JAMES R, et al. Detailed appraisal of the offshore wind industry in China [M]. London: The Carbon Trust, 2014. [23] WANG Y M. Adhere to market oriented reform of the electricity sector [OL]. (2016-05-25).http://www.nea.gov.cn/2015-03/09/c_134049283.htm. [24] SUN S P, LIU F L, XUE S, et al. Review on wind power development in China: current situation and improvement strategies to realize future development [J]. Renewable and Sustainable Energy Review, 2015(45): 589-599. [25] ZHAO Z Y, CHANG R D, CHEN Y L. What hinder the further development of wind power in China? a socio-technical barrier study [J]. Energy Policy, 2016(88): 465-476. [26] Tencent Financial News. National energy board officials say: the development of new energy involves a significant adjustment of interests [OL]. (2016-07-06)[2016-08-10]. http://finance.qq.com/a/20160706/023877.htm. [27] KEYAERTS N, MEEUS L. The experience of Italy and the US with exceptional regulatory incentives for exceptional electricity transmission investments[R]. Florence: RSCAS-European University Institute, 2015. -

下载:

下载: