-

广东是天然气消费大省,但进口LNG占比高达70%,对外依存度高,天然气利用价格长期处于高位,严重影响了能源供应安全和能源利用成本。当前广东天然气市场化机制还不完善,市场在资源优化配置中的作用有待提升,因此亟需建立广东天然气交易市场,构建多渠道多主体市场交易格局,形成有国际影响力的基准定价枢纽,以保障天然气供应安全、降低天然气利用成本。

国内对天然气交易市场的研究不算太多,主要集中在国际成熟天然气交易市场情况及对我国的启示[1-2]、中国天然气市场结构及机制设计[3-4]等方面,相关成果主要针对全国市场。然而中国幅员辽阔,不同地区的市场基础和特点千差万别,没有一个“放之四海而皆准”的天然气市场框架,各区域必须根据市场具体情况构建适合当地特点的市场框架。目前,国内尚未有专门针对广东的天然气交易市场研究,文章结合广东天然气资源条件、基础设施、市场基础等情况,研究适应广东实际的天然气交易市场构建方案。

-

经过多年发展,欧美天然气市场建成了多个能源交易所和多个交易枢纽,并通过竞争逐渐形成英国NBP[5]、荷兰TTF[6]、美国Henry Hub[7-8]基准定价交易枢纽。

能源交易所作为天然气交易平台,负责开展天然气商品交易,包括天然气现货、期货和期权等交易品种。参与方不但包括天然气生产商和用户,还包括贸易商、中间服务商、银行、基金和其他金融机构。合同种类包含围绕着实物交割的现货、即期、远期合同,以及采用风险管理和资产优化的套期保值合同,或者是实物与金融相结合的期货合同。交易枢纽负责天然气的储运交割,是由专门的运营机构管理的天然气物理交割设施负责天然气的物理交割、接卸、仓储、运输、调度、平衡等。

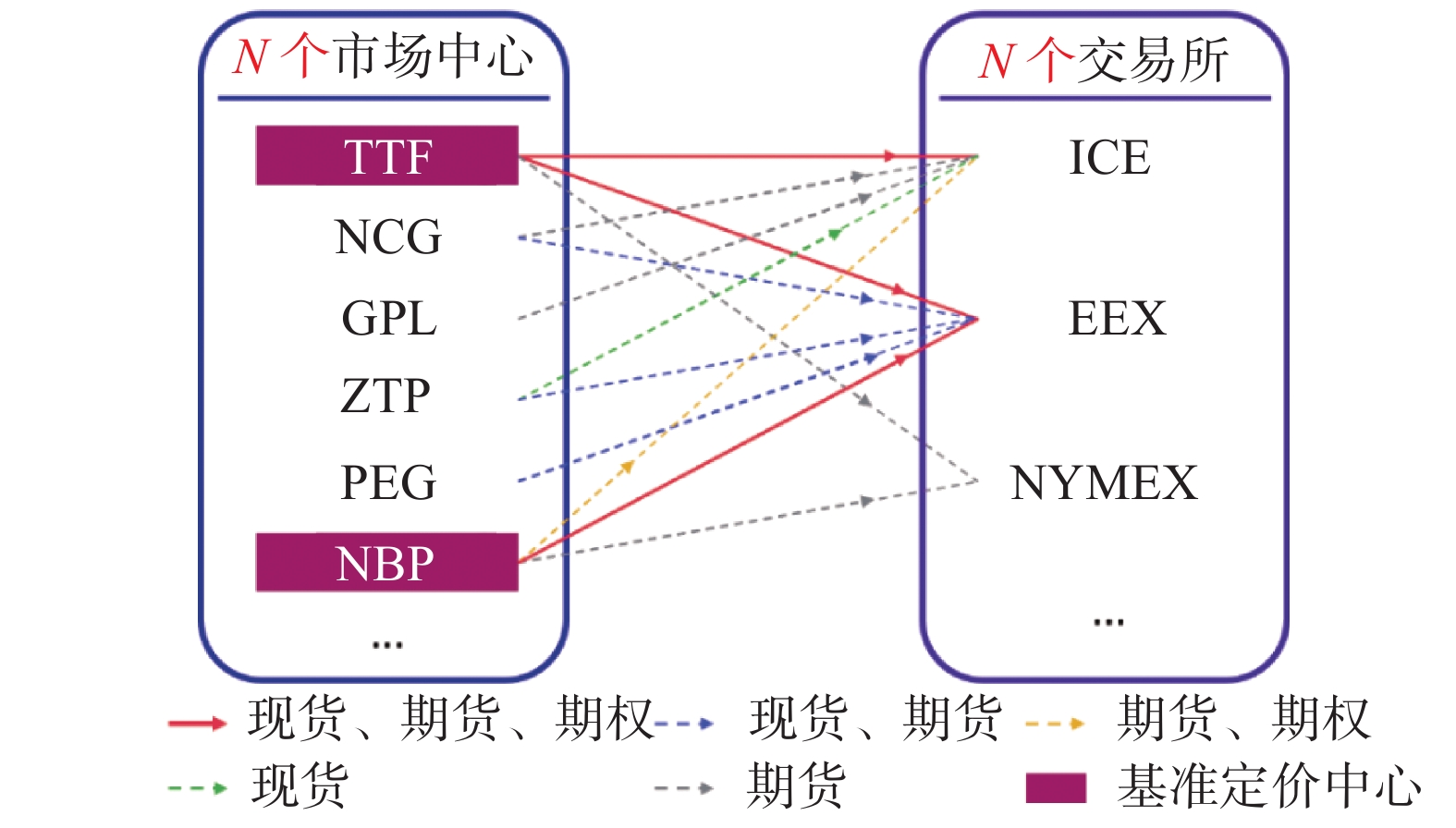

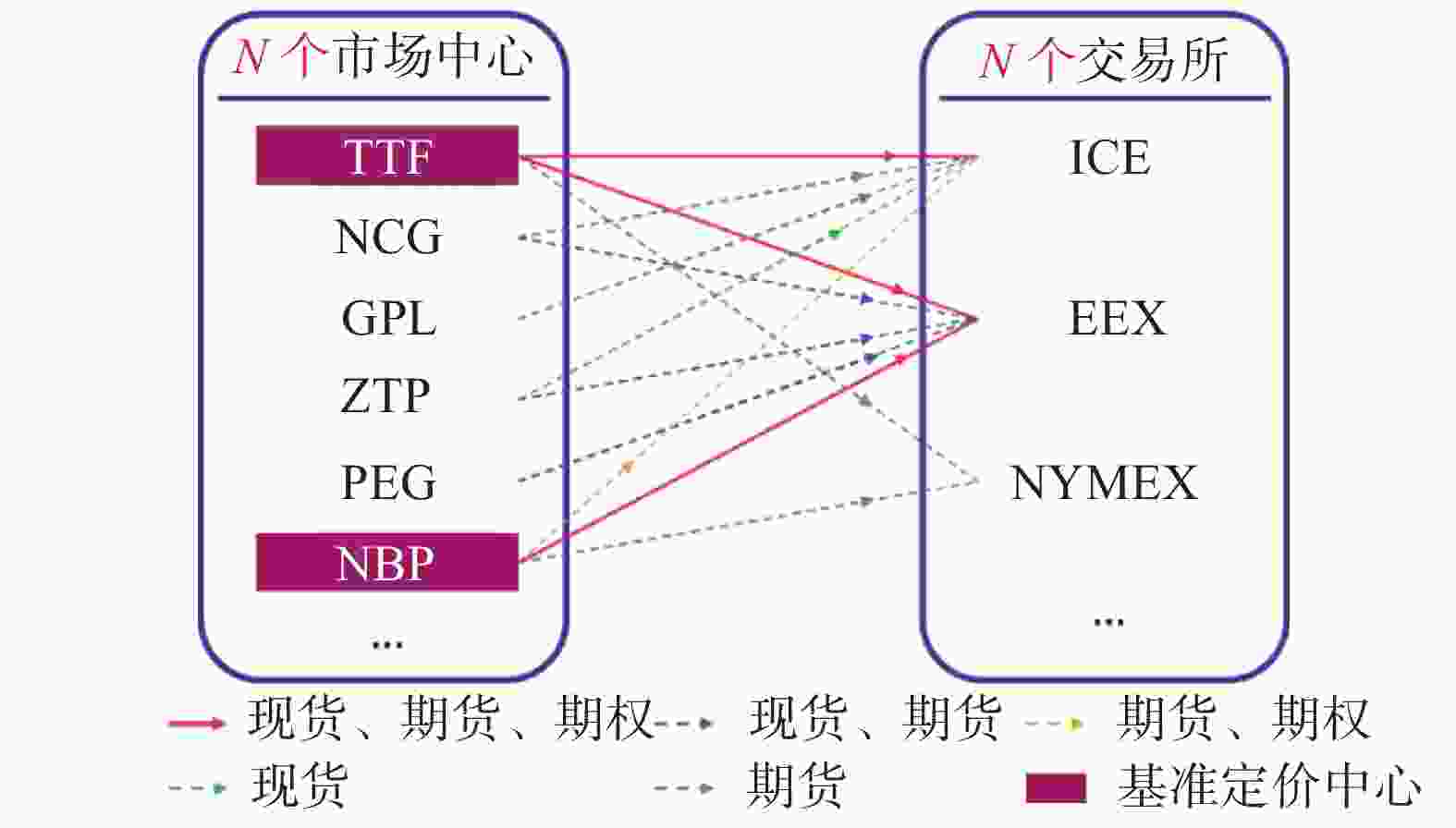

截至目前,欧洲在运交易枢纽约18个,交易量较大的有英国NBP、荷兰TTF、德国NCG、德国GPL、比利时ZTP、法国PEG等,基于交易枢纽的各类商品交易主要集中在伦敦洲际交易所ICE、欧洲能源交易所EEX及纽约商品交易所NYMEX,欧洲天然气市场体系构架如图1所示。

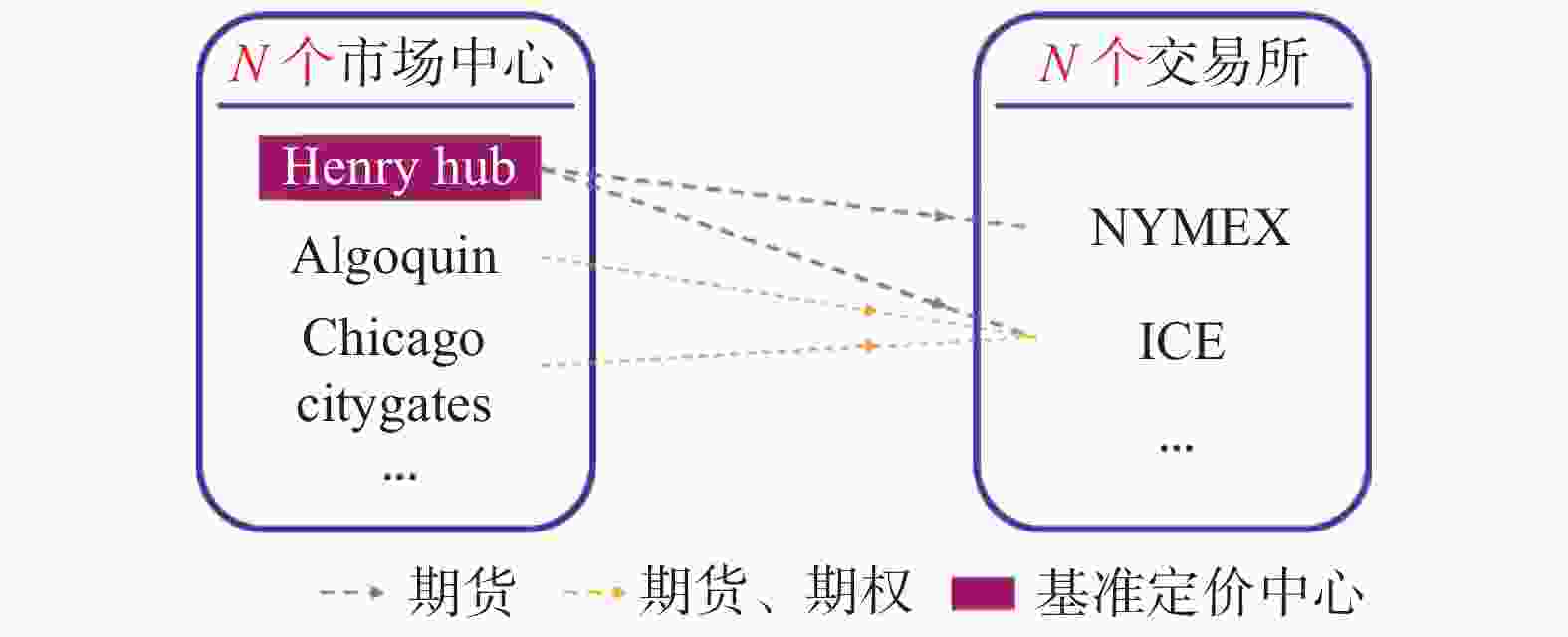

美国建立了Henry Hub、Algoquin、Chicago citygates等20余个交易枢纽,基于交易枢纽的各类交易主要集中在纽约商品交易所NYMEX及伦敦洲际交易所ICE。因交易规模大、市场流动性高,英国NBP、荷兰TTF、美国Henry Hub脱颖而出,逐步发展成为基准定价交易枢纽,美国天然气市场体系构架如图2所示。

-

英国NBP于1996年建立,范围包括英国境内的整个输气管网(National Transmission System,简称NTS),现由National Grid公司管理(National Grid独家拥有英国天然气长输管道设施,并拥有英国境内8个区域配气网络中的4个)。NTS是一个由7 600 km天然气管线、23个天然气压缩站、206个天然气下气点、9个天然气接收站和9个天然气存储设施组成的天然气运输物理基础设施。国家输气系统为60个直接连接的大型用户(40个天然气发电站和20个大型工业用户)供应天然气,同时也为8个配气企业所辖区域供应天然气。NBP是一个虚拟交易枢纽,将整个区域管网设定为一个虚拟的点或交易位置,任何一处的天然气价格都相同。NBP内的管网互联互通,天然气气质和气压保持一致。天然气托运商完成市场交易后,把天然气输入NBP的注气点并由下游买方到指定提气点提货。在整个过程中,NBP为各方提供运输服务,保持管网系统平衡、跟踪并记录交易量。天然气在NBP内可自由流动,无确定的输送路径,按照注入或流出点计算运输费用。NBP是伦敦洲际交易所天然气期货合约的定价点和交割点,其天然气价格被认为是欧洲天然气市场主要的风向标。2019年NBP活跃市场主体数量约135家,实际交割量约893亿m3,期货交易量和实际交割量的比值高达14.3,交易流动性仅次于TTF。

-

荷兰TTF成立于2003年,与NBP一样,TTF具有实物交易和金融投资功能,市场透明度和交易保障度得到了市场主体的广泛认可,欧洲大陆众多能源交易所都推出了以TTF为交割地的天然气现货、期货、期权品种。虽组建时间较晚,但得益于地理位置优越、基础设施完善、气源供应充足、提供不同热值天然气转换服务、管道运营商提供跨国管道容量绑定交易等有利因素,TTF迅速发展成为欧洲大陆的基准交易枢纽,其他欧洲大陆交易枢纽的价格基本是根据TTF的价格升贴水定价。2019年TTF活跃市场主体数量约167家,实际交割量约426亿m3,期货交易量和实际交割量的比值高达97.1,成为欧洲流动性最强的交易枢纽。

-

美国Henry Hub成立于1988年5月,是美国建立时间最早、规模最大的天然气交易枢纽,由萨宾(Sabine)管道公司运营。Henry Hub位于美国天然气管网最为发达的地区,连接着主要的天然气产区、消费区、储气库和LNG出口终端,可为市场主体灵活调整天然气的供应来源和消费市场,大幅提高天然气交易的灵活性。

目前,Henry Hub已发展为一个全服务的集输系统,提供各种天然气接收、处理、交付、储存和管网调峰等服务,并与美国其他天然气管网形成广泛互联。特别是近年来由于国际天然气需求不断增加,以及美国页岩气革命带来的天然气产量、运输量激增,使得Henry Hub成为了全球重要的LNG气源地,其发布的指导价格越来越多地被各地期货交易所和媒体广泛引用,成为全球重要的天然气基准价格之一。

-

国内天然气交易市场建设仍处在起步探索阶段。目前已组建的天然气交易中心包括上海、重庆、浙江、深圳、海南等,除此之外,山东、江苏等地也在筹建准备成立天然气(能源)交易中心。与欧美地区不同的是,国内天然气(能源)交易中心建设的侧重点主要在交易平台,类似欧美国家的交易所,如ICE、NYMEX等。

国内交易枢纽的规划和建设相对滞后,目前尚未形成有真正物理交割的交易枢纽,现阶段上海、重庆、海南等交易所成交的天然气的交割主要由实际交割地的省级管网公司提供储运服务,统购统销的格局尚未完全打破。国家层面已在全面推进管网改革,各省级管网公司正陆续启动重组并逐步融入国家管网,未来将形成更加高效的管输系统,有利于打造天然气交易枢纽。

-

国际经验表明具有定价权的天然气交易市场,需要建立在成熟的物理基础和制度基础之上,通过交易所和交易枢纽共同发力、相辅相成。物理基础是完备的、可以完成交割的管网及接收站基础设施。制度基础包括强有力的监管、打破市场垄断、培育市场主体、形成上游多主体多渠道供应、统一管网、高效集输、确保第三方公平获得基础设施、建立健全批发市场、创造交易需求、提高交易流动性、建立基于需求和供应的定价机制、产生竞争性市场价格、开展期货等金融衍生品开发和推广、扩大衍生品交易市场流动性和交易规模、竞争性立法等。欧洲、美国的经验表明,构建成熟的天然气交易市场,打造有国际竞争力的基准定价枢纽,至少需要10~15 a的培育过程,需要推动交易所与交易枢纽共同建设,两者相辅相成,缺一不可。

-

扩大天然气利用,是广东省实现碳达峰碳中和战略目标、优化能源结构、推动能源高质量发展的重要举措。2021年全年天然气消费量364亿m3,跃居成为全国第一。随着“煤改气”的大力推进和香港淘汰煤电机组进程的深入,大湾区新建和规划燃气电厂项目将逐步建成,城镇燃气和工业用能向清洁化方向发展,预计2025年天然气消费总量将超过480亿m3,高于荷兰始建交易枢纽时天然气消费量(2003年消费总量约420亿m3),到2030年将达到530亿m3。旺盛的天然气需求正是形成一个崭新的、活跃的、流动性强的、可信任的天然气交易市场的重要前提条件之一。

-

广东省天然气供应能力持续增强,已形成沿海进口LNG、陆上跨省管道天然气、海上天然气等“多源互补、就近供应”的供气格局,供应能力约每年500亿m3。未来新增的气源主要包括新开发的海上天然气、南海可燃冰的规模化开采利用、新建LNG接收站、新疆煤制气和西气东输三线等资源。南海深水气田不断有较大的发现,南海海域远期供应能力将超过100亿m3/a。广东省内多样的气源、不断提升的天然气供应量可为天然气上游主体形成多元化竞争格局提供先决条件。省内日趋完善的天然气管网和LNG接收站等基础设施可为天然气交易所的市场供需平衡、实物交割提供基础设施保障。两者共同夯实了广东发展天然气市场化交易的基础。

-

广东在天然气价格改革、管网运营代输、接收站公平开放等方面经过实践具备先发优势。省管网公司自成立以来一直采取代输经营模式,天然气资源输送到省级主干管网,省级管网提供代输服务,并收取合理管输费,同网同价;深圳大鹏LNG接收站、珠海金湾LNG接收站已按要求向第三方开放,其他LNG接收站的开放也在有序推进;天然气代输和城镇燃气统购统销价格由相关价格主管部门按照“准许成本加合理收益”的原则定价;年用气量达到1 千万m3以上、靠近主干管道且具备直接下载条件的工商业用户可实施直供。基于广东区位优势、经济优势、先发优势构建天然气交易市场,可为国内外能源企业、天然气贸易商提供更加健康有序的市场环境与便捷高效的市场服务。

-

广东省天然气消费量大,气源多、基础设施完善、配套条件好,具有与英国等欧洲主要国家可比的市场规模、基础设施条件及多元化的市场基础,具备建设类似欧洲的虚拟交易中心模式的优势,可率先试点建成区域交易中心,形成国际可接受的市场化价格指数,为整个中国天然气市场化改革的成功开辟一条新的道路。

-

推进天然气市场化改革,构建有效竞争的市场结构和市场体系,形成上游多家气源主体供应,中游基础设施公平开放和统一调度监管,下游充分竞争的“进天然气市场”的天然气市场化竞争格局,建成品种齐全、功能完善、竞争充分、设施完备的天然气交易市场,不断提高资源配置效率,形成具有国际影响力的天然气基准定价枢纽,助力我国能源结构转型,保障国家能源安全。

-

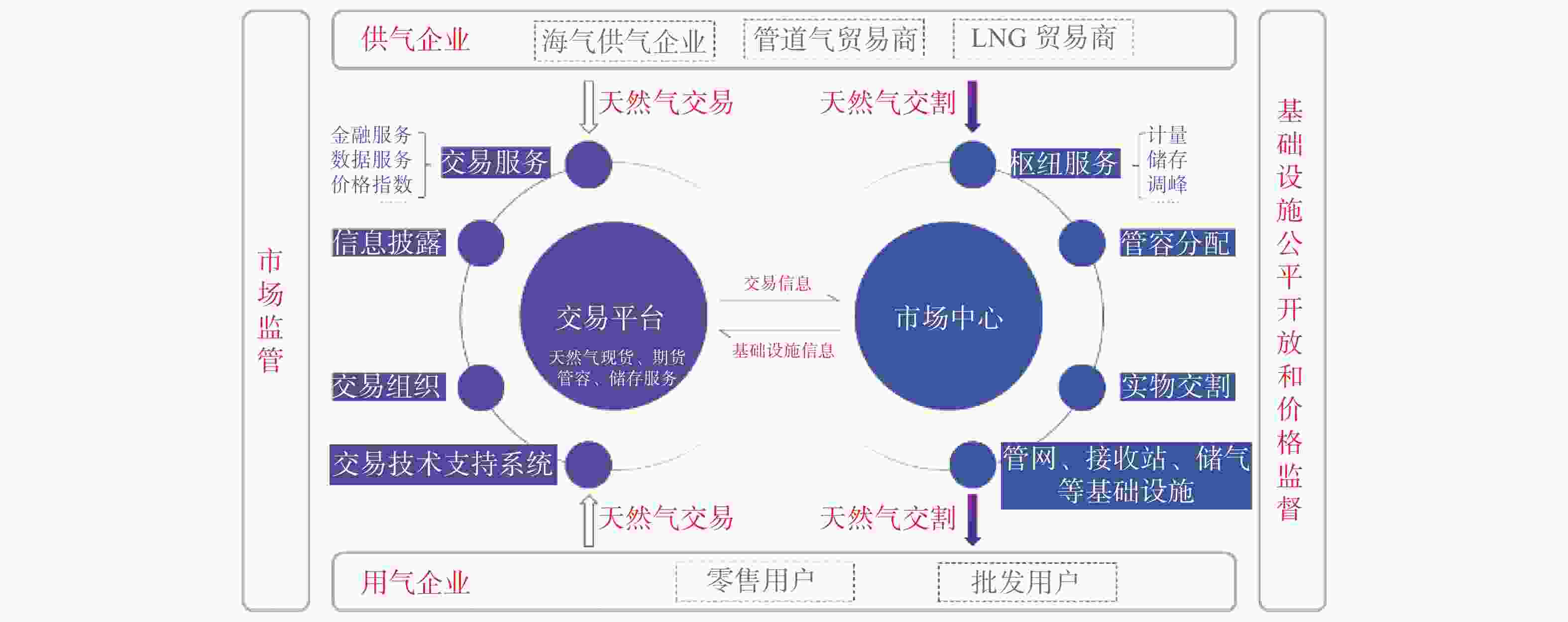

构建交易所、交易枢纽协同发展的天然气交易市场体系,其中天然气交易所,负责组织开展天然气交易;基础设施完善的交易枢纽,负责实现天然气资源自由流动,顺畅交割。市场主体通过交易所或场外交易形成的天然气买卖合同,通过交易枢纽进行天然气实物交割和运输。政府相关部门依法对天然气交易市场运行和基础设施公平开放进行监管。广东天然气交易市场总体架构如图3所示。

交易所在政府监管下为市场主体提供规范、公开、透明的天然气交易服务,是天然气交易业务的组织实施机构,履行天然气市场交易管理职能。主要负责市场交易系统的建设、运营和管理;负责天然气交易市场政策、交易规则研究;负责组织天然气交易,汇总供气企业与用气企业自主签订的双边合同;负责市场运营管理,包含市场主体注册管理、披露和发布市场信息;负责提供结算凭证和相关服务;负责提供其他交易相关的服务;依法接受政府主管和监管部门的监管。

交易枢纽在政府监管下为市场主体提供天然气储运、LNG接受等服务,无歧视地向用户提供报装、计量、抄表、维修、改道等服务。主要负责管道、LNG接收站、储气等基础设施的建设、运营和管理,确保足够的储存及运输能力;负责管网调度与平衡,并保证系统的安全性、经济性和可靠性;负责计量系统的建设、运营和管理,计量天然气的数量、热量和气体成分;披露和发布基础设施相关信息;负责提供其他枢纽相关服务;依法接受政府主管和监管部门的监管。

行业监管主要包括市场交易监管、基础设施公平开放监管、管输环节价格监管三部分,市场监管促进天然气市场体系设计和性能的公平竞争;基础设施公平开放监管确保管网接入是无差别的、透明的和公平定价的,从而使市场竞争发挥作用,并使天然气管道基础设施得到有效利用。

-

天然气交易所负责搭建和运营交易所,负责为市场主体提供规范、公开、透明的天然气交易服务,组织实施天然气交易业务,履行天然气市场交易管理职能。

目前,国内新设天然气交易机构存在种种困难,包括国家能源局对油气交易所未来发展趋势和方向还不明确、国家清理整顿各类交易场所等因素。2021年1月,中共中央办公厅、国务院办公厅印发《建设高标准市场体系行动方案》提出:“通过股份制改造、兼并重组等多种方式,在油气、电力、煤炭等领域积极培育形成运营规范、具有较大影响力的交易所。支持上海期货交易所、全国电力交易机构、全国煤炭交易中心充分发挥作用,进一步健全交易机制、完善交易规则、严格监管标准。鼓励具备条件的资源型地区依托现有交易场所,探索建设区域性能源资源交易中心。”

依据广东实际情况,可考虑依托现有相关能源交易机构,增设天然气交易品种,或与交易枢纽运营机构一体化建设。

-

交易枢纽运营机构负责交易枢纽的搭建和运营,按照股份制公司形式完成组建,负责建成类似英国荷兰TTF或英国NBP的任一接口输入及任一交气点输出的标准化的管道天然气交割场所,负责天然气的物理交割、接卸、仓储、运输、调度、平衡、计量、信息披露等工作。可考虑由基础设施运营企业共同组建股份制公司,形成交易枢纽运营机构。

-

市场交易规则方面,起步阶段天然气现货市场以管道天然气、液化天然气为品种,以双边协商、集中竞争为交易模式,形成包含交货地点、时间等核心条件的天然气买卖合同。持续完善交易品种和交易模式,建设包含中长期、日前及日内实时交易完整的现货市场。结合天然气市场化改革推进情况,适时建设天然气服务市场主要包括储气服务市场、接收站(窗口期)接收能力市场、管输容量市场等。

市场运营规则方面,根据国家及省市相关政策,编制合法规范且符合交易需求的交易管理制度及规章,规范交易所运作,为市场参与主体提供明确入市指导,主要包括会员管理制度、交易管理制度及其他重要管理制度。

-

全面强制推行管网和LNG接收站公平开放,推动广东境内所有主干管网和LNG接收站,进行管输和销售分离,采用“代输”“代加工”模式运行,由政府核定“代输”“代加工”费用标准,向市场主体公布相关信息。

-

建立全省干线管道统一调度机制,推动实现全省一张网,负责管网压力平衡、管输容量分配和使用,提升管网集约输送和公平服务能力。

-

加快制定合理的管容分配机制,并形成托运商制度,连通买卖双方,合理的托运商机制有助于捋清天然气输配环节中的各方责任,形成运销分离后的合理的管网运营方式,提高管网的使用效率,使管容分配更透明、更公平,提高天然气购销效率。

-

明确气质统一标准,开展气质测量工作,确保枢纽管道内气质统一。组织开展各种市场交易执行结果的计量工作,出具市场交易结算的计量凭证。

-

建设功能完善的交易系统,满足各类品种交易管理和市场监管要求。系统建设遵循交易规则和主要技术标准,实行统一标准、统一接口。

-

建设功能完善的基础设施信息公开和管容交易系统,主要功管能一是管容等基础设施信息公开发布;二是管容一、二级市场交易,其中一级管容市场交易是管道公司把管容出售给托运商,二级管容市场交易是托运商之间进行被释放的管容、不平衡气量的交易。

-

研究制定天然气市场化交易的配套政策,起步阶段,通过行政推动,引导气源供应商、天然气经营企业、天然气发电厂等大用户等聚集到交易所集中开展交易。

-

现货市场是价格发现的基础和前提,期货市场是发现价格的主要场所。欧美的经验表明,期货等金融衍生品更能吸引金融交易主体的参与,形成流动性,促进发现真实价格。在形成连续有效的天然气现货价格指数后,探索开发天然气期货交易品种。

-

在放开更多的直供用户后,更多的工业、发电用户可以自主选择供气方实现天然气市场化交易。通过天然气场外交易备案管理机制,由交易所全面汇总场内、场外交易信息,全面掌握全省天然气交易动态,适时推出广东省天然气价格指数。

-

政府相关主管部门制定监管体系,包括市场交易监管、基础设施公平开放监管、管输环节价格监管三部分,市场监管促进天然气市场体系设计和性能的公平竞争;基础设施公平开放监管确保管网接入是无差别的、透明的和公平定价的,从而使市场竞争发挥作用,并使天然气管道基础设施得到有效利用。

-

广东是天然气消费大省,但天然气利用价格长期处于高位,亟需建立广东天然气交易市场,形成有国际影响力的基准定价枢纽。从欧美成熟天然气交易市场建设经验来看,形成定价权的天然气交易市场,需要建立在成熟的物理基础和制度基础之上,通过交易所和交易枢纽共同发力、相辅相成。广东省天然气消费量大,气源多、基础设施完善、配套条件好,可参考欧洲建设NBP、TTF等的虚拟交易枢纽,同是联合推进天然气交易所建设,形成国际可接受的市场化价格指数。

文章参考国际先进经验,结合广东实际情况,提出了打造广东“文参考国际先”的天然气市场化竞争格局,建成品种齐全、功能完善、竞争充分、设施完备的天然气交易市场,提出交易所、交易枢纽协同发展的天然气交易市场体系,并明确了建设交易所和交易枢纽的目标和重点任务。提出的建设目标、方案和任务对广东天然气交易市场建设具有较强的指导意义,有望形成具有国际影响力的天然气基准定价枢纽,助力我国能源结构转型,保障国家能源安全。

Suggestions on Building a Natural Gas Trading Market in Guangdong

-

摘要:

目的 广东省是天然气消费大省,但是天然气进口依存度高、缺乏定价话语权,天然气利用价格长期处于高位,亟需建立广东天然气交易市场,形成有国际影响力的基准定价枢纽,以保障天然气供应安全、降低天然气利用成本。 方法 研究欧洲和美国天然气市场化改革的过程,总结其经验要点,得出对广东天然气市场的启示;分析广东天然气市场结构、基础设施和市场化改革的现状;构建适合广东实际情况的天然气市场框架、提出推动天然气市场建设的重点任务。 结果 研究表明:广东省天然气需求旺盛、供应多元、基础设施完备、市场化基础良好、金融市场完善,具备建设区域虚拟交易枢纽的基础条件,可参考英国NBP和荷兰TTF模式,构建天然气交易枢纽和交易所协同发展的天然气交易市场体系。天然气交易枢纽方面重点推进天然气运输服务和销售业务分离、建立干线管网统一调度机制、建立管容分配和托运商制度、建立基于热值的计量制度、搭建基础设施信息公开和管容交易系统等任务。天然气交易所方面重点制定市场交易和运营规则、搭建交易信息系统、推动天然气期现对接和期货品种等。 结论 所提方案符合广东实际、具备可操作性,可有效指导广东天然气交易市场建设。 Abstract:Purpose Guangdong Province is a major consumer of natural gas. Since it is highly dependent on natural gas imports and lacks the right to speak in pricing, the natural gas utilization price has been high for a long time. There is an urgent need to establish a natural gas trading market in Guangdong and develop a benchmark pricing hub with international influence so as to secure the natural gas supply and reduce the natural gas utilization costs. Method Studied the process of natural gas market-oriented reform in Europe and the United States, summarized their experiences, and drew inspiration for the Guangdong natural gas market; analyzed the current natural gas market structure, infrastructure and market-oriented reform in Guangdong; built a natural gas market framework suitable for the actual situation of Guangdong, and proposed the key tasks to promote the construction of a natural gas market. Result The research shows that Guangdong Province has a strong demand for natural gas, diversified supply, complete infrastructure, good marketization foundation, and perfect financial market. It has the basic conditions for building a regional virtual trading hub. A natural gas trading market system with coordinated development of natural gas trading hubs and exchanges can be established by referring to the British NBP and Dutch TTF models. The natural gas trading hub focuses on key tasks of promoting the separation of natural gas transportation services and sales operations, creating a unified scheduling mechanism for the trunk pipeline network, constructing a pipe capacity allocation and shipper system, establishing a calorific value-based measurement system, and building infrastructure information disclosure and pipe capacity trading systems. The natural gas exchange focuses on formulating market trading and operating rules, building a trading information system, and promoting the connection between natural gas spot trading and futures trading as well as the futures varieties. Conclusion The proposed scheme conforms to the actual situation of Guangdong and is operable, which can effectively guide the construction of a natural gas trading market in Guangdong. -

Key words:

- natural gas /

- trading market /

- trading hub /

- exchange /

- Guangdong /

- market-oriented reform

-

[1] 姜鑫, 乔佳, 铁宇, 等. 欧洲天然气市场化发展现状及对中国的借鉴 [J]. 煤气与热力, 2021, 41(2): B37-B40. DOI: 10.13608/j.cnki.1000-4416.2021.02.021. JIANG X, QIAO J, TIE Y, et al. Development status of European natural gas marketization and its reference to China [J]. Gas & Heat, 2021, 41(2): B37-B40. DOI: 10.13608/j.cnki.1000-4416.2021.02.021. [2] 周璇, 董秀成, 周淼, 等. 实体和虚拟天然气交易枢纽的对比研究 [J]. 中国矿业, 2019, 28(3): 44-51. doi: 10.12075/j.issn.1004-4051.2019.03.026 ZHOU X, DONG X C, ZHOU M, et al. Comparative study of physical trading hub and virtual trading point [J]. China Mining Magazine, 2019, 28(3): 44-51. doi: 10.12075/j.issn.1004-4051.2019.03.026 [3] 杨雷, 陈新华, 孙慧, 等. 我国天然气市场化改革路径与试点选择相关建议 [J]. 油气与新能源, 2021, 33(2): 28-31. DOI: 10.3969/j.issn.2097-0021.2021.01.006. YANG L, CHEN X H, SUN H, et al. Market-oriented reform routes and piloting of natural gas in China [J]. Petroleum and New Energy, 2021, 33(2): 28-31. DOI: 10.3969/j.issn.2097-0021.2021.01.006. [4] 苏念悠, 张占一, 柴姝霞, 等. 中国天然气交易中心建设的现状与展望 [J]. 中国水运, 2021, 21(12): 14-16. SU N Y, ZHANG Z Y, CHAI S X, et al. Current situation and prospect of construction of natural gas trading center in China [J]. China Water Transport, 2021, 21(12): 14-16. [5] 瞿新荣. 美国和英国天然气价格指数启示录 [J]. 能源, 2019(6): 86-90. QU X R. Apocalypse for US and UK gas price indices [J]. Energy, 2019(6): 86-90. [6] 蔡其其. 国际天然气期货市场对我国能源股票市场溢出效应实证研究 [D]. 昆明: 云南财经大学, 2022. DOI: 10.27455/d.cnki.gycmc.2022.000230. CAI Q Q. Empirical study on the spillover effect of international natural gas futures market on China’s energy stock market [D]. Kunming: Yunnan University of Finance and Economics, 2022. DOI: 10.27455/d.cnki.gycmc.2022.000230. [7] NICK S, THOENES S. What drives natural gas prices?—A structural VAR approach [J]. Energy Economics, 2014, 45: 517-527. DOI: 10.1016/j.eneco.2014.08.010. [8] LOVCHA Y, PEREZ-LABORDA A. Dynamic frequency connectedness between oil and natural gas volatilities [J]. Economic Modelling, 2020, 84: 181-189. DOI: 10.1016/j.econmod.2019.04.008. -

下载:

下载: